Daniel Shainberg

October 2, 2018

As we have warned previously the Eurozone is specifically at risk for serving as the catalyst for the next global recession. Excess sovereign debt may not cause the recession, but it certainly can fuel it, exacerbating the trough and limiting the monetary toolkit for bankers, especially when debts are denominated in foreign currency. This is what we published on September 16, 2018:

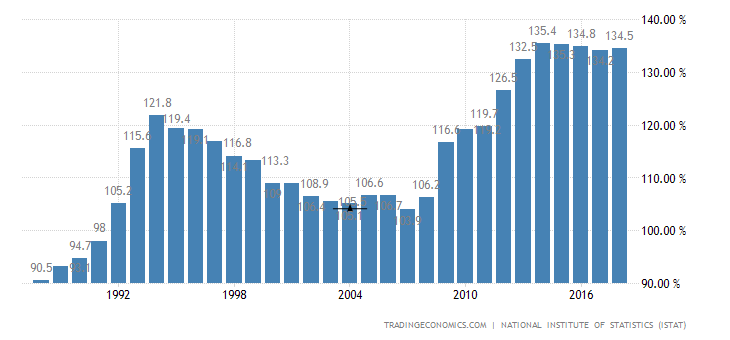

"Italy is in the European Union and has a debt/GDP ratio of 130%. Typically any country with over 100% debt to GDP is in big trouble. Given Italy's interconnected economy to the rest of Europe, a blowup in Rome could easily cause a nasty contagion effect whereby the ECB assumes their sovereign debt and imposes austerity or the Eurozone breaks apart. In either situation an economic crush would likely follow" (Recession Resister Newsletter: "The Next Recession" 9/16/18).

This chart shows the increase in leverage in Italy.

Last weekend I traveled to Yosemite National Park and listened while on a guided tour to a young park ranger enthusiastically explain how the forest actually needs fires to survive. She stated that European settlers who arrived over a hundred years ago mistakenly thought the fires they witnessed were killing the Sequoia trees, so they implemented expensive fire suppression techniques. That is until they realized the forest was eroding even faster. Then they hired a scientist to study the problem and make recommendations. His conclusion was that the Sequoias needed the fires to clear out brush so their seeds have room to grow, and quite contrary to popular belief, the Sequoias are naturally fire resistant. Natural forest fires are healthy in the long run. The problem is if you suppress the natural fires. Then you get tinder, shrub, moss and other fuel that can quickly turn a mild fire into a raging uncontrolled wildfire. That is what we have been experiencing recently, and those types of forest fires are unhealthy for the Sequoias as they can burn dozens of feet up the trees, sometimes reaching the canopy, exhausting the tree's natural defenses.

After years of excess sovereign debt inflation we are entering a point where the leverage is no longer a common cyclical non-issue. It is growing out of control and could act as the tinder for the next global recession turning what should be a standard recession into a global meltdown.

Excess sovereign leverage is not a great predictor of the timing of the downturn, but it can identify the potential degree of harm, and what we see now is a record breaking uncontrolled fire on the horizon. Nobody rings a bell at the top, and the recent and corporate earnings and macro-economic reports are meaningless. They express past results that are largely induced by the excess debt injected into the global economy. Earnings reports are malleable. They can move drastically and quickly as we saw in 2008 and 2009. But the debt doesn't disappear. Robert Shiller and Edward Chancellor are expressing concern.

Everyone is assuming earnings will rise forever, and traditional credit analysis is being thrown out the window to save market share. These are classic investor-psychology warning signs of a peak. Chancellor argues that record low interest rates since the financial crisis produced zombie companies that are surviving only because of low rates. Normally recessions clear out the weak companies and force austerity on overly leveraged nations. These mini-recessions clear out the brush and garbage. It forces investors to reallocate capital to healthier productive enterprises similar to how natural forest fires clear out the forest so the Sequoias can spread their seeds and attract enough sunlight to grow. Failure is essential to the rebound. Equally, business failures are essential to a recovery. But what we are seeing now in the global economic system are central bankers acting like the early European settlers in Yosemite, wasting lots of resources in a manner that is sure to backfire at some point.

Today the market may have finally started incorporating this risk as global stocks slumped led by a European selloff. The Euro dropped relative to the U.S. dollar as Italy’s bond yields shot up to multi-year highs. Recognizing the obvious Claudio Borghi said that Italy should have its own currency which is a fancy way of saying "we ain't gonna be able to pay you back." Borghi said that the euro is not sufficient for Italy to solve fiscal issues. No kidding!

The Italian 10 year yield rose to 3.438%, the highest level since early 2014.

Even the Wall Street banks are starting to come around: "While our economists do not expect systemic implications for the global economy, contagion risks have risen. We think European risky assets remain vulnerable, and there is potential for negative spillovers to the Euro area given the high trade exposure to Italy" (Goldman Sachs).

Dan Shainberg

#DanShainberg

#RecessionResister

@DanShainberg

@DanShainberg

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.