Just a few newsletters ago we warned of the risk inherent in Boeing’s market capitalization.

We also noted that the inflationary trends from the Defense sector from the past 5-10 decades are unlikely to persist given the obvious mathematical dilemmas that occur when the government reduces tax receipts and increases its debts and deficit at the peak of the economic cycle while interest rates skyrocket higher. At some point the math just doesn’t work. Now, the news of today that sent Boeing (BA) down >8% wiping 150bps off the Dow along with it is entirely unrelated to our bearish long-term thesis. They spent a ton of capital to develop a new plane. The plane crashed. It was a brand new Boeing 737 MAX 8 jet operated by Lion Air. Now the market is baking in a slight possibility that there are serious costs to retool and fix manufacturing problems and/or 1-time litigation payments.

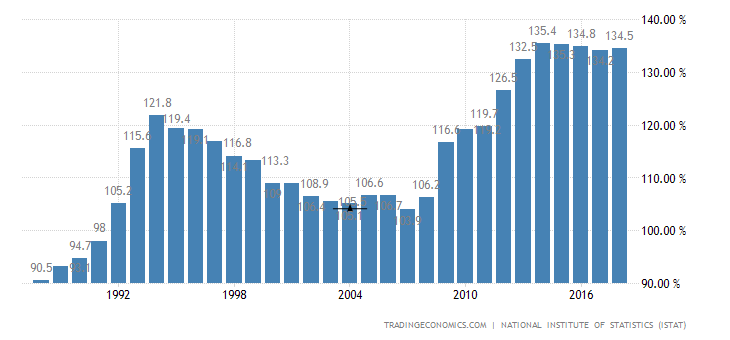

This could easily be a pre-cursor for a long term Boeing bear market. Ultimately investors in Boeing need to incorporating the risk of a dividend cut. When you have 1 major customer (the U.S. government), and that customer cannot pay you and also can legally restrict you from selling your products to others, that becomes a major problem. When you combine that with a cyclical decline in the emerging markets, which historically have been the most volatile geographic sector of the macro-economy, that becomes the recipe for GE style dividend cuts. Savers who bid up BA shares over the past decade assuming they are a bellwether, nifty-fifty name will be shocked just like GE shareholders were in 2018.

Dan Shainberg