September 20, 2018

The 2008 financial crises had its consortium of contestants who shared in the blame. But only one player had a phrase named after them. The banking cartel was skewered for being "too big to fail." It was their massive size that forced the government to push for bailouts as too many failures of these interconnected institutions would, as they argued, create a downward spiral to the entire global economy.

In the decade since 2008 the government and its posse of regulators have swooped down upon the industry like hawks. They are often found roaming the hallways of large banking institutions, as they should. We cannot let such a repeat occur where Main Street must bail out Wall Street. But Wall Street is no dummy. Over the past decade many corporations went private to avoid the regulatory spotlight and bask in the glory of excess cheap debt. Take Elon Musk's Tesla as an example. While a nearly $80 billion leveraged buyout was obviously not going to close, even Elon got bit by the "go-private" bug.

Unlike the conditions leading to the 2008 crises, the current poison that can amplify the next downturn is hidden in the private financial markets.

Central bankers around the world have assumed trillions in debt on their balance sheets to promote the "economic recovery." Globally there was an estimated nearly 4x increase in central banking debt from $5 trillion last decade to almost $20 trillion today.

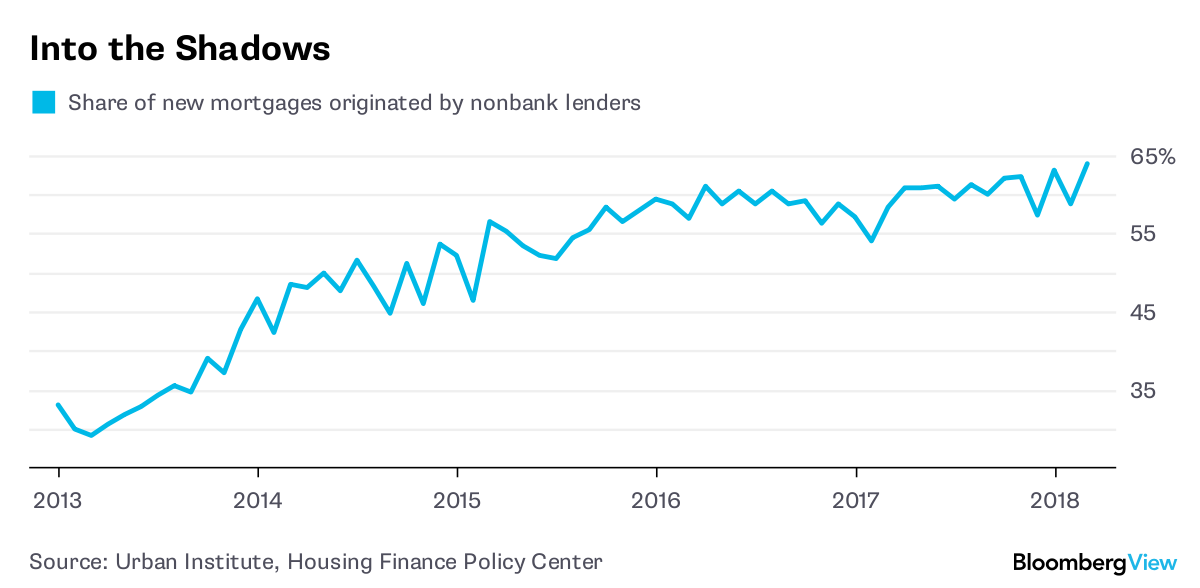

This debt finds its way into the corporate system. Given the regulatory oversight in the mortgage industry, the debt trickled down to other less scrutinized sectors of the economy like private loans and private equity buyouts. There is a popular new trend of "non-bank lenders" that have soaked up the loans that regulated banks shied away from. Such lenders include money managers, bond funds, pension funds and insurance companies. Even equity market derivative contracts are being sold by these players to collect the much sought after yield. This is shockingly similar to the selling of mortgage backed derivatives in the years preceding the 2008 financial crises.

The private equity market is a great bellwether for the economic cycle. Today, the average private equity backed company has a leverage ratio of ~6x annual earnings, double the level at which point ratings agencies deem comparable public companies to be classified as "high yield."

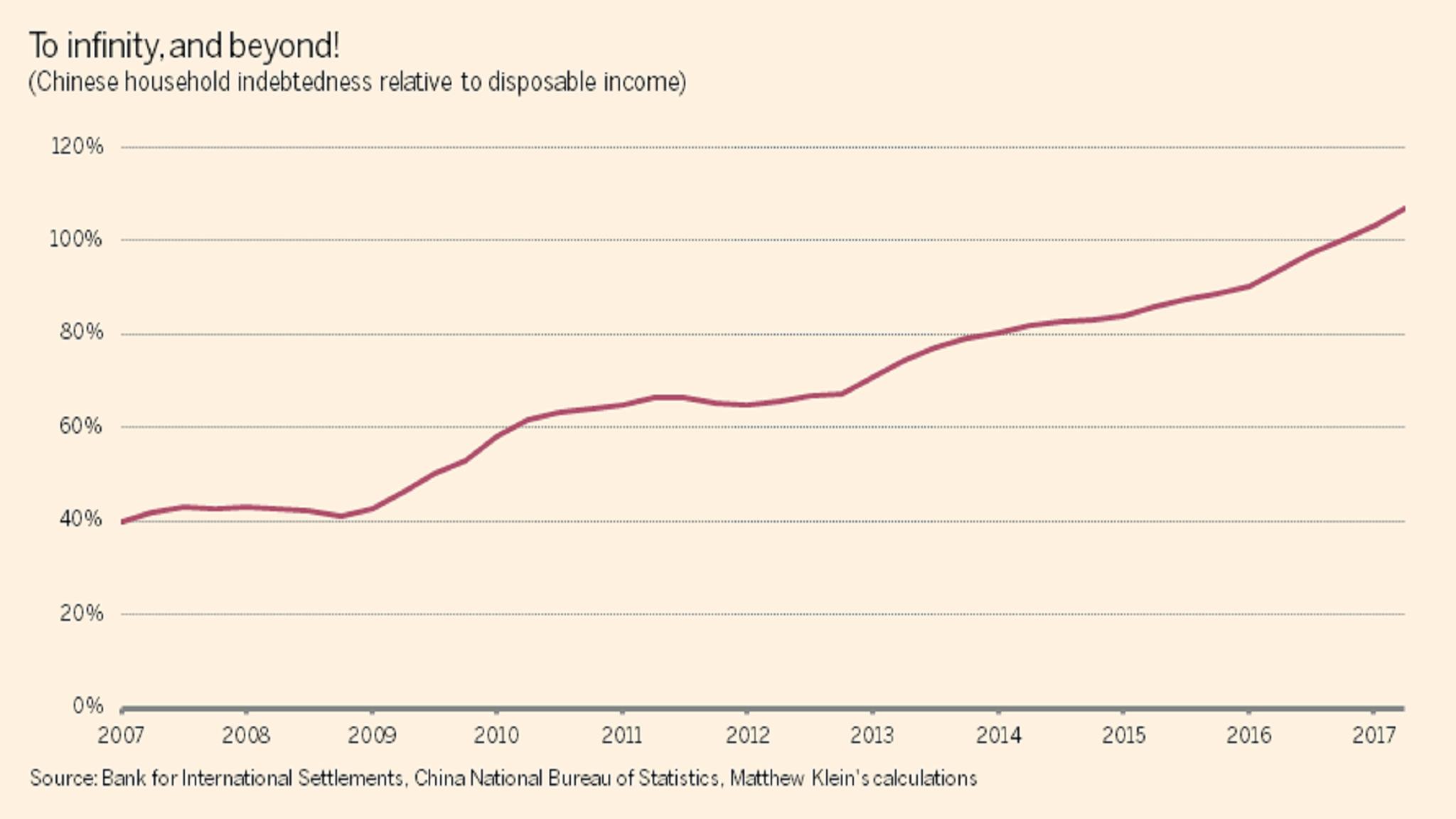

A simple search of Chinese non-bank lending, often referred to as "shadow financing," shows the rapid increase over the past few years. Like the too big to fail American banks of 2008, the global shadow lending markets have grown “too big to hide” in 2018.

Dan Shainberg

#DanShainberg

#RecessionResistor

@DanShainberg

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.