Daniel Shainberg

12/17/2018

The mainstream financial news networks prefer to discuss & debate the impact of new & exciting changes. Whether technological innovation or reported growth in corporate America’s eagerly awaited earnings releases, they rely on these headlines

to scroll across the bottom of the television screen to entice your interest and most importantly, your eyeballs. That is how they make money. But what we see being discussed today may not be the right discussion when thinking about the direction of the markets.

Warren Buffett is famous for shunning exciting investment opportunities that may be rife with risk while favoring the old, stodgy, boring businesses that continuously print off cash flows through economic cycles. That type of thinking can

be applied to the financial news. What do we see being discussed today?

• Interest rates are spiking

• Retailers experiencing a global apocalypse

• Inflationary costs & hyper-competitive e-tailers & app developers

• Frozen credit markets, specifically leveraged loans post a peak CLO market

• Goldman Sachs bankers face criminal charges for the 1MDB scandal

• Political unrest in France, problems in Venezuela

• Conflicts arising between the U.S. and China, and renewed • Russo / Ukraine tensions

While all of these topics are legitimate elements of concern for the economy, the stock market has an even bigger threat and headwind which is also the likeliest explanation of the volatility we are experiencing today.

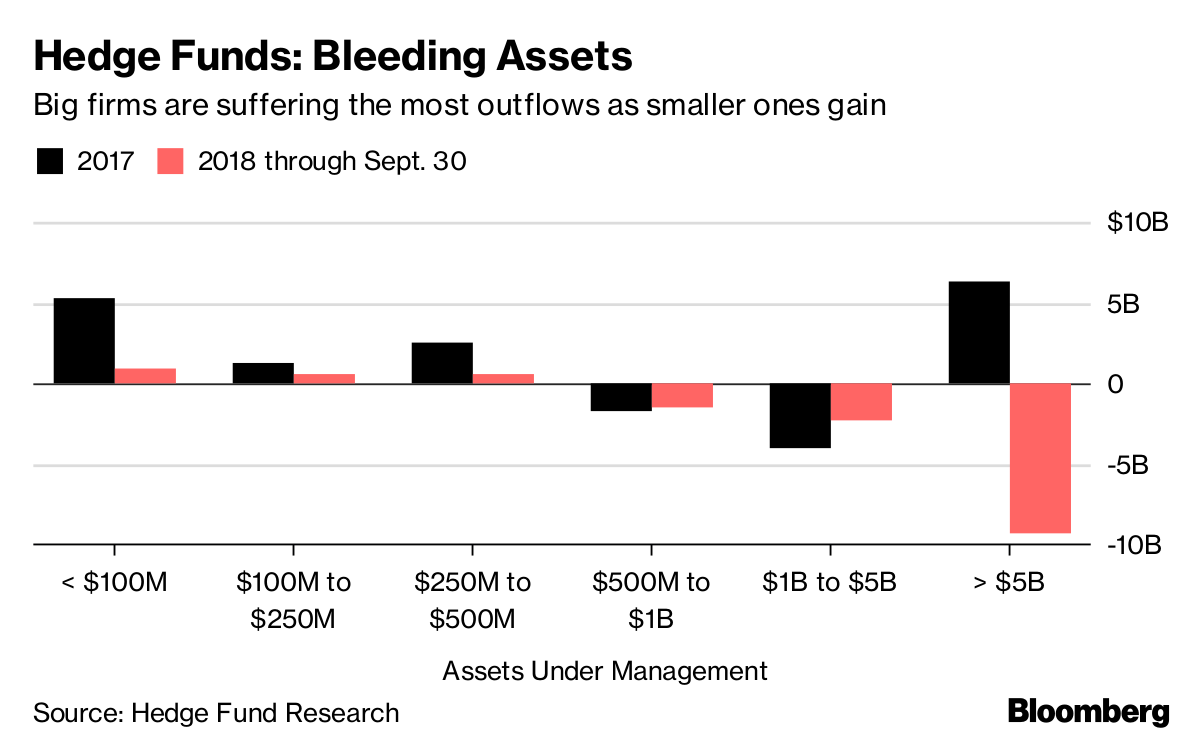

The top 500 hedge funds control ~90% of industry assets according to Preqin research. Hedge Funds control an estimated $2.5 trillion in assets. The market capitalization of the entire S&P 500 is ~$20 trillion. While the market capitalization

of the entire stock market is larger than just this single index, the average daily volume of the all U.S. stocks is ~$75-$125 billion. So comparing hedge fund assets to the average daily volume of stocks, one can see just how massive this ownership class

is relatively speaking. Any forced selling from margin calls or investor redemption requests could unleash a wave of falling dominoes that sends the U.S. equity markets down to 2009 levels, or worse.

The hedge fund industry is highly cyclical and amplified by the use of margin debt to improve returns. Most fund managers invest in the same names as their colleagues in the industry. They cannot mathematically all outperform each other.

Once they start under-performing the indexes, investors flee. That has already began. Investors want uncorrelated opportunities without volatility.

Most hedge fund managers analyze overvalued and over-hyped securities like Tesla and the FANG stocks and pursue short bets against them. They are analytically correct bets. But in the short term, with all of their friends and colleagues

pursuing the same trades, volatility and redemption demands can lead to a multiplier effect working against them. Value is getting crushed by momentum. Overvalued story stocks are generating returns because of short covering. And the potential to create reasonable

risk adjusted returns in the public markets is growing more and more difficult.

The good news is that for those investors who have been patiently waiting on the sidelines, their day may come when it becomes time to catch a falling knife and invest in attractive opportunities. It just feels like that day has yet to come. Wait to see hedge funds blowing up.

The good news is that for those investors who have been patiently waiting on the sidelines, their day may come when it becomes time to catch a falling knife and invest in attractive opportunities. It just feels like that day has yet to come. Wait to see hedge funds blowing up.

Dan Shainberg

#DanShainberg

#RecessionResister

@DanShainberg

@DanShainberg

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.